The Benefits Of A Paid Off House: Financial Freedom And A Brighter Future For Parents

As parents with young children, the financial burden of a mortgage can feel overwhelming, often leaving us with limited resources for our family’s needs. This article will explore the benefits of a paid off house, demonstrating how it can free up cash flow, reduce stress, and provide a solid foundation for a brighter future.

Financial Stability and Peace of Mind

A paid-off house lays a strong foundation for financial stability, allowing families to enjoy reduced monthly expenses and increased cash flow for other priorities. The sense of security that comes from knowing your home is yours, free from any financial obligations, can be truly transformative for parents striving to create a nurturing environment for their children.

Reduced Monthly Expenses

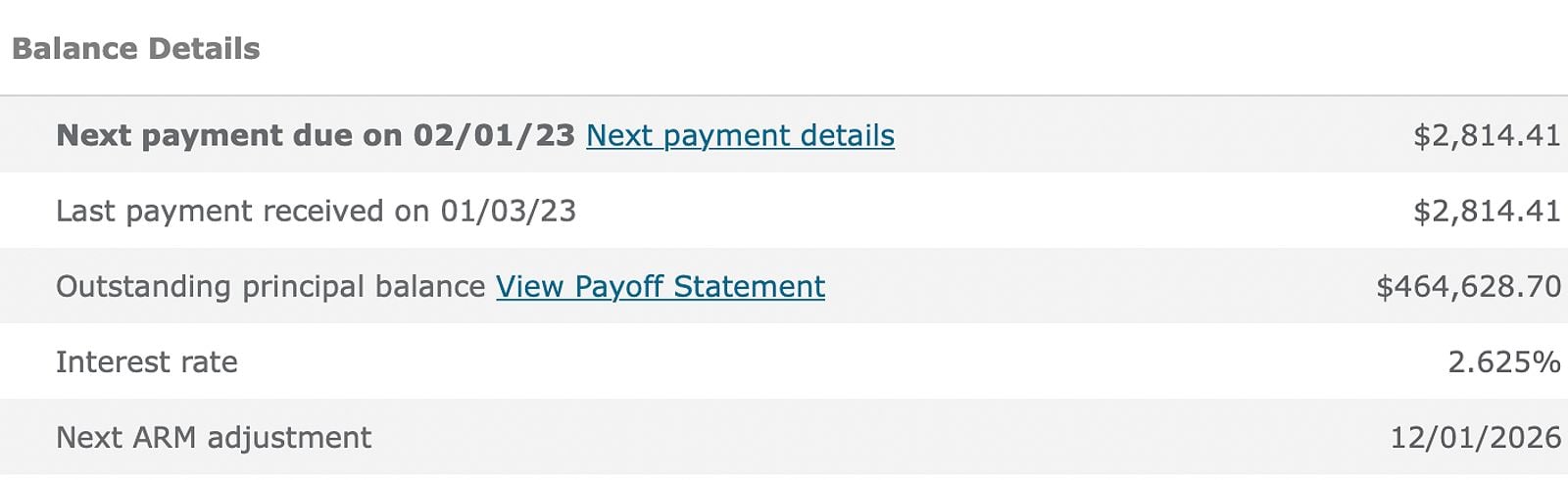

One of the most significant advantages of having a paid-off house is the elimination of monthly mortgage payments. This financial relief can free up thousands of dollars annually, transforming our family’s budget and providing us with the opportunity to allocate funds toward our priorities.

Imagine a scenario where your typical mortgage payment is around $2,000 per month. That amounts to $24,000 a year, which can be redirected toward savings, investments, or even family vacations. This shift in financial focus can make a substantial difference in your family’s lifestyle, providing better opportunities for financial planning and flexibility.

With the burden of a mortgage removed, we can allocate funds toward essential expenses such as healthcare, education, and retirement savings. For instance, we can enhance our children’s education by investing in tutoring, extracurricular activities, or college savings plans, ensuring a bright future for our kids. The ability to invest in these critical areas not only improves our family’s quality of life but also sets the stage for our children’s success.

Increased Cash Flow

A paid-off house significantly boosts a family’s cash flow. Without the mortgage payment, we can channel this extra money into various financial goals, such as building an emergency fund, investing in retirement accounts, or establishing a college savings plan for our children.

For example, consider a family that typically spends $3,000 a month on living expenses. By removing the mortgage payment from the equation, they can redirect a considerable portion of that budget into strategic investments that yield long-term benefits. This newfound cash flow empowers families to make informed financial decisions that enhance their overall stability.

In addition to saving for emergencies or retirement, the extra cash flow can also enable families to take advantage of investment opportunities that may arise. Whether it’s purchasing stocks, investing in real estate, or starting a small business, having the financial flexibility to act on these opportunities can lead to significant financial growth over time.

Reduced Financial Stress

Living without the burden of a mortgage payment can drastically lower financial stress. Many of us worry about job security and the ability to meet monthly payments. A paid-off house alleviates these concerns, allowing us to focus on enjoying our lives together.

The psychological benefits of being debt-free extend beyond financial worries. Studies indicate that financial stress can adversely affect mental health, leading to anxiety and depression. By eliminating mortgage payments, we can significantly improve our overall well-being, fostering a healthier and more harmonious home environment.

Moreover, the reduction in financial stress can lead to improved relationships within the family. When we’re not constantly worried about money, we can be more present and engaged with our children. This positive environment can enhance family bonds and create lasting memories, as we’re more likely to participate in activities and experiences that foster connection.

Creating a Secure Future for Your Family

A paid-off house not only benefits us in the present but also establishes a secure future for our children. The stability and security that come with homeownership can create a nurturing environment for our children to grow and thrive.

Guaranteed Housing

Owning a home outright guarantees families a stable and affordable place to live, regardless of market fluctuations or economic downturns. This security is especially valuable for parents striving to provide a nurturing environment for their children.

The fear of rising rents or potential eviction is eliminated, allowing us to concentrate on our well-being rather than worrying about housing insecurity. In times of economic uncertainty, having a paid-off house acts as a buffer against financial hardships. For example, if a parent loses their job, not having to make mortgage payments provides necessary breathing room to navigate such challenges without the added stress of losing our home.

Additionally, a paid-off house can serve as a long-term asset that appreciates over time. This appreciation can be beneficial for families looking to build wealth or for those who may want to downsize or relocate in the future. The value of a home can provide significant financial leverage, enabling us to access funds for other investments or endeavors when needed.

Financial Legacy

A paid-off house serves as a valuable asset that can be passed down to our children, offering them financial support and a head start in life. This legacy not only provides immediate benefits but also imparts lessons about financial responsibility and the importance of homeownership.

The concept of generational wealth is often discussed in financial circles, and a paid-off home can significantly contribute to this strategy. By leaving behind a mortgage-free property, we ensure our children have an appreciating asset that enhances their financial stability and opportunities.

Moreover, passing down a paid-off house can also instill values of hard work and financial prudence in our children. They can learn about the importance of saving, investing, and making informed financial decisions, which can benefit them throughout their lives. By providing a solid financial foundation, we can help our children avoid the pitfalls of debt and financial instability.

Financial Freedom and Flexibility

One of the most significant advantages of owning a paid-off house is the financial freedom it provides. This freedom empowers us to make choices that align with our values and aspirations, enhancing our overall quality of life.

Career Flexibility

Without the pressure of a mortgage, we may feel more comfortable exploring career changes or entrepreneurial ventures. The financial cushion that comes from owning a home outright allows us to pursue our passions without the constant worry of meeting monthly mortgage obligations.

For instance, a parent who has always dreamed of starting their own business may be more inclined to take that leap when they are not burdened by a mortgage. This newfound freedom can lead to greater job satisfaction and a more balanced family life, as we can align our work with our personal goals.

Additionally, career flexibility can lead to improved job performance. When we are not stressed about our financial situation, we can focus on our work and pursue opportunities for advancement or professional development. This can lead to increased job satisfaction, higher earnings, and greater overall happiness.

Lifestyle Choices

A paid-off house enables us to make lifestyle choices that prioritize family time and personal well-being. With the financial burden of a mortgage lifted, we can invest in experiences that matter most to us, such as travel, hobbies, or quality time together.

For example, consider a family that wishes to take a vacation together each year. Without the monthly mortgage payment, they can allocate funds toward travel, allowing them to create lasting memories. This emphasis on experiences rather than material possessions can foster stronger family bonds and a more enjoyable life overall.

Moreover, having the freedom to make lifestyle choices that align with our personal values can lead to greater fulfillment. We can choose to spend more time volunteering, participating in community events, or engaging in hobbies that bring us joy and satisfaction. This focus on meaningful experiences can enhance our overall happiness and well-being.

Investing in Your Children’s Future

The financial advantages of a paid-off house extend to our children, allowing us to invest more resources into their education and development. This investment in the future can have lasting impacts on our children’s lives.

College Savings

Eliminating a mortgage payment can free up funds that we can dedicate to our children’s college savings. With rising education costs, having a robust college savings plan is essential. By redirecting the money previously allocated to mortgage payments into a college fund, we can ensure that our children have access to quality education and future opportunities.

We can take advantage of various college savings plans, such as 529 plans, which offer tax benefits and can grow over time. By investing in our children’s education, we not only secure a brighter future for them but also instill the value of education and financial planning.

In addition to college savings, we can also invest in our children’s primary and secondary education. This might include funding private school tuition, tutoring services, or educational technology, all of which can enhance their learning experiences and academic success.

Extracurricular Activities

Being mortgage-free also provides the financial flexibility to enroll our children in extracurricular activities that enrich their lives. Whether it’s sports, music lessons, or art classes, these experiences can foster personal growth and development. Investing in such activities not only benefits our children but also strengthens family bonds as we engage in our children’s interests and passions.

Extracurricular activities can play a crucial role in a child’s overall development, helping them build confidence, learn new skills, and develop social connections. By having the financial means to support these activities, we contribute to our children’s well-rounded growth and happiness.

Additionally, participating in extracurricular activities can help our children discover their passions and interests. This exploration can lead to lifelong hobbies, career paths, and friendships, creating a more fulfilling childhood experience.

Tips for Achieving Mortgage Freedom

For parents aspiring to enjoy the benefits of a paid-off house, here are some practical tips to help achieve mortgage freedom.

Create a Budget

Establishing a realistic budget is crucial for managing expenses and identifying areas where savings can be made. By tracking spending and making adjustments, we can allocate more funds toward mortgage payments, accelerating the path to homeownership. A well-planned budget can help us distinguish between needs and wants, allowing us to prioritize our financial goals effectively.

Moreover, a budget can help us identify areas where we can cut back on spending. This might include reducing discretionary expenses, such as dining out or entertainment, and reallocating those funds toward mortgage payments.

Increase Income

Exploring opportunities to increase income can also aid in paying off a mortgage faster. We can consider seeking promotions, taking on side jobs, or even starting a home-based business. Every additional dollar earned can contribute to reducing the mortgage balance. This proactive approach not only helps in achieving mortgage freedom but also instills a sense of accomplishment and motivation.

For example, we might consider leveraging our skills or hobbies to generate extra income. Whether it’s freelance work, consulting, or selling handmade crafts online, these additional income streams can make a significant difference in achieving mortgage freedom.

Prioritize Debt Paydown

Focusing on paying down high-interest debt can free up cash flow for mortgage payments. By eliminating high-interest obligations first, we can redirect our financial resources toward achieving mortgage freedom. This strategy can significantly accelerate the process of paying off the house and reduce the overall interest paid over time.

Additionally, we can consider consolidating our debts to lower interest rates and simplify payments. This can make it easier to manage our finances and prioritize mortgage paydown effectively.

Make Extra Payments

Encouraging ourselves to make extra payments on our mortgage, even small amounts, can significantly shorten the payoff timeline. Regularly contributing additional funds can lead to substantial savings on interest payments and help us reach our goal of a paid-off house sooner. For instance, even adding an extra $100 to each monthly payment can make a difference in the total interest paid and the length of the mortgage.

We can also consider making lump-sum payments when we receive bonuses, tax refunds, or other windfalls. This approach can drastically reduce the principal balance and accelerate the mortgage payoff process.

Frequently Asked Questions

Q: Isn’t it better to invest the money instead of paying off my mortgage?

A: While investing can yield higher returns, paying off your mortgage provides a guaranteed return through saved interest payments and reduces monthly expenses, enhancing overall financial security.

Q: How can I afford to make extra payments on my mortgage?

A: We can make extra payments by utilizing windfalls, bonuses, or tax refunds. Automating extra payments or rounding up monthly payments can also help in accelerating the payoff process.

Q: What if I need to move before my mortgage is paid off?

A: If you need to move, having a paid-off house can provide you with greater flexibility. You can sell the property and use the proceeds to purchase a new home without the burden of a mortgage. Alternatively, you could consider renting out the property, generating income while maintaining ownership.

Q: Can I still benefit from tax deductions if I pay off my mortgage?

A: While paying off your mortgage eliminates the ability to deduct mortgage interest, you may still benefit from other tax deductions, such as property taxes. Additionally, the peace of mind and financial freedom gained from being mortgage-free can outweigh the loss of these deductions.

Conclusion

The benefits of a paid-off house are numerous and can significantly enhance the quality of life for parents with young children. By providing financial stability, peace of mind, and the ability to invest in our children’s futures, a paid-off home stands as a powerful financial strategy. As parents who focus on achieving mortgage freedom, we not only secure our financial well-being but also create a nurturing environment for our families to thrive. Investing in a paid-off house is ultimately an investment in a brighter future for both us and our children, fostering a sense of security and empowerment that can last for generations.

MORE FROM findbusiness.me