How Much To Contribute To A 529 Plan: A Step-by-step Guide For Parents Of Teenagers

College costs have been rising, and it can feel overwhelming to save enough for your teenager’s higher education. But with the right strategy, a 529 plan can be a powerful tool to help you reach your savings goals. In this comprehensive guide, we’ll walk you through the process of determining the right contribution amount for your 529 plan, considering your child’s college aspirations, your current savings, and the latest changes to these tax-advantaged accounts.

Understanding Your Childs College Goals

In-State vs- Out-of-State

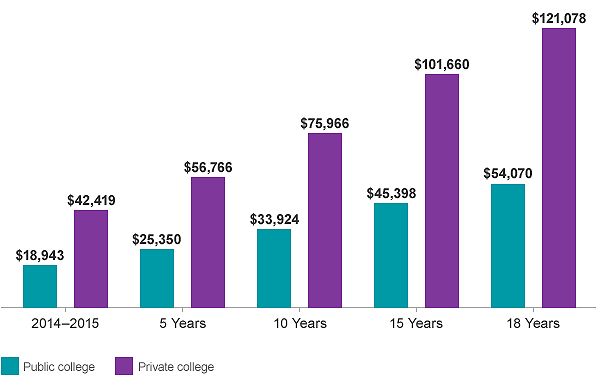

One of the first things to consider is the cost difference between attending an in-state public university and an out-of-state or private institution. The average annual cost for a four-year public in-state university in 2024 was around $26,000, while a four-year private college averaged about $55,000 per year. These figures highlight the importance of setting realistic savings goals based on your child’s dreams.

If your teenager has their heart set on a prestigious out-of-state university, your 529 plan contributions will need to reflect those higher costs. On the other hand, if they are interested in a more affordable in-state option, your savings target may be lower.

Desired Major and Career Path

Your teenager’s chosen field of study can also impact the college selection and associated costs. Students pursuing degrees in high-demand fields like engineering, medicine, or specialized programs often face higher tuition fees. Researching the potential costs of different programs and institutions that align with your child’s interests can help you determine your savings target.

For example, a student interested in a pre-med program at a top-tier private college may require significantly more savings than one pursuing a liberal arts degree at a public university. Understanding these financial commitments early can help you make informed decisions about your 529 plan contributions.

Financial Aid and Scholarships

Exploring financial aid and scholarship opportunities is crucial in deciding how much to put in a 529 plan. Many families underestimate the availability of scholarships or the impact of financial aid on their overall college costs. Resources like the Free Application for Federal Student Aid (FAFSA) and scholarship search engines can provide valuable information to factor into your savings plan.

By considering potential aid and scholarships, you can adjust your 529 contributions accordingly. For example, if your child is a strong academic performer, they may qualify for significant merit-based scholarships, allowing you to reduce the amount you need to save in your 529 plan.

Assessing Your Current 529 Plan Status

Current Balance and Growth

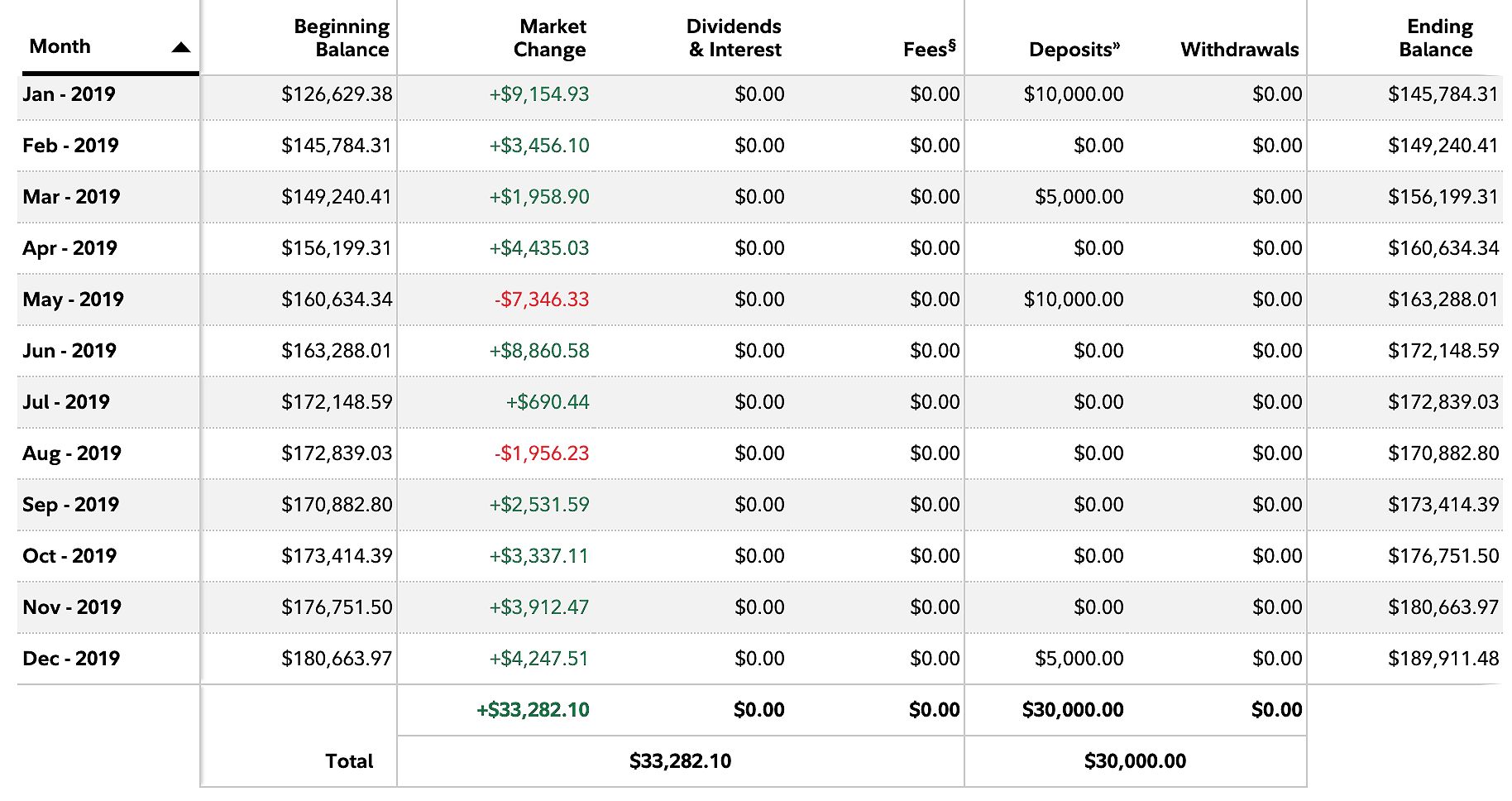

Start by reviewing your existing 529 plan’s current balance and historical growth rate. Analyzing this information will give you insight into your savings progress and help identify any potential gaps. Creating a simple table to visualize your 529 plan balance at different ages can clarify how much more you need to save.

This exercise can also help you understand the impact of your past contributions and investment performance on your current savings. By tracking your 529 plan’s growth over time, you can make adjustments to your contribution strategy as needed.

Investment Strategy

The investment strategy of your 529 plan is another important factor. Evaluate whether your current investment options align with your risk tolerance and long-term growth expectations. Different investment choices, such as target-date funds or index funds, can significantly impact your savings.

For instance, a more aggressive investment strategy with a focus on growth-oriented funds may yield higher returns over time, but it also comes with increased risks. Conversely, a more conservative approach with a balanced portfolio may provide more stability but lower potential returns. Striking the right balance between risk and reward can help you maximize your 529 plan’s growth.

Contribution History

Reviewing your past contributions is essential for understanding your saving patterns. Look for areas where you can increase contributions or adjust your frequency to better align with your savings goals. Automating your contributions can help you stay on track with consistent savings.

Identifying gaps or inconsistencies in your contribution history can provide valuable insights. Perhaps you were able to contribute more during certain years, or there were periods when your contributions fell behind. Recognizing these trends can inform your future 529 plan strategy.

How Much to Contribute to 529: Determining the Right Amount

College Cost Projections

Calculating the appropriate contribution amount for your 529 plan involves projecting future college costs. Online calculators or a financial advisor can help you estimate expenses, factoring in inflation. For example, covering four years at a public in-state university might require around $150,000 in savings, while a private college could exceed $300,000.

These projections can serve as a starting point, but it’s important to remember that actual costs may vary based on your child’s specific situation. As you get closer to college, you can refine your estimates and make any necessary adjustments to your 529 plan contributions.

Time Horizon

The time you have until your child attends college plays a crucial role in your contribution strategy. The longer the time horizon, the more your contributions can benefit from compounding growth. Use a chart to illustrate recommended contribution amounts based on the number of years left until college, which can help you understand how much you should be saving now.

For instance, if your child is 10 years away from college, you may need to contribute a smaller amount each year to reach your savings goal. Conversely, if they are only 5 years away, you’ll likely need to contribute a larger amount annually to catch up.

Investment Return Expectations

Setting realistic expectations for investment returns is important. While historical data shows average annual returns of around 6-8% for a balanced portfolio, it’s wise to adopt a more conservative approach and assume a 5% annual growth rate when planning your 529 contributions.

By considering different return assumptions, you can create a range of potential outcomes and adjust your contribution strategy accordingly. This approach can help you make informed decisions and avoid disappointment if your investments don’t perform as expected.

Maximizing Your 529 Plan Contributions

Tax Benefits

One of the primary advantages of 529 plans is the tax benefits they offer. Contributions grow tax-deferred, and qualified withdrawals are tax-free, making them a powerful tool for college savings. Many states also provide tax deductions or credits for 529 plan contributions, which can significantly enhance your savings potential.

Researching your state’s specific tax benefits can help you maximize your contributions. For example, if your state offers a generous tax deduction for 529 plan contributions, it may be worth contributing more to take advantage of the additional savings.

Gift Tax Exclusion

The annual gift tax exclusion allows individuals to contribute larger amounts to 529 plans without incurring gift tax. In 2024, individuals can gift up to $18,000 per year to any person without tax liabilities. For 529 plans, you can utilize a special 5-year rule, enabling you to contribute up to $90,000 (or $180,000 for married couples filing jointly) at once.

This strategy can be particularly beneficial if you have the financial means to front-load your 529 plan contributions. By effectively gifting 5 years’ worth of contributions in a single year, you can maximize the tax-deferred growth of your savings.

State Tax Deductions

Certain states offer tax deductions or credits for contributions made to 529 plans. Researching your state’s policies can help you identify opportunities to enhance your savings through strategic 529 plan contributions.

For example, if your state provides a 100% tax deduction for 529 plan contributions, it may be more advantageous to contribute to your state’s 529 plan rather than another state’s plan, even if the investment options are not as favorable.

Automatic Contributions

Setting up automatic contributions is an effective way to ensure consistent savings. Automating your contributions allows you to contribute regularly without having to remember to do so, making it easier to stay on track with your savings goals.

By setting up automatic transfers from your bank account, you can create a disciplined savings habit and avoid the temptation to divert those funds for other purposes. Over time, these consistent contributions can add up and make a significant difference in your 529 plan’s growth.

Navigating the Latest 529 Plan Changes

Expanded Uses for 529 Funds

The SECURE Act 2.0 introduced several enhancements to 529 plans that can benefit parents of teenagers. You can now use 529 funds for K-12 tuition, apprenticeship programs, and up to $10,000 in student loan repayments for both the beneficiary and their siblings. Understanding these new uses can help you adjust your contribution strategy and make the most of your 529 plan.

For example, if your child is interested in pursuing a skilled trade through an apprenticeship program, you can now use your 529 plan to cover those expenses. This added flexibility can help you optimize your college savings and ensure your teenager has the resources they need to achieve their educational and career goals.

Rollover to Roth IRA

Starting in 2024, you have the option to roll over unused 529 plan funds into a Roth IRA, subject to certain limitations. This flexibility can provide additional long-term tax-advantaged growth for your child’s future financial well-being.

By rolling over 529 plan funds to a Roth IRA, you can potentially extend the tax-advantaged growth of those assets beyond college and into your child’s adult life. This can be a valuable strategy for families who have exceeded their college savings needs or want to provide their child with a head start on retirement planning.

Impact on Contribution Strategy

These recent changes may significantly influence your contribution strategy and long-term savings goals. Consider how the expanded uses for 529 funds and the Roth IRA rollover option can be integrated into your overall financial plan.

For instance, you may decide to contribute more to your 529 plan, knowing that you can now use the funds for a wider range of educational expenses. Alternatively, you may choose to contribute less if you plan to take advantage of the Roth IRA rollover option to provide your child with additional long-term financial flexibility.

FAQ

Q: How much should I have saved in my 529 plan by the time my child is 18?

A: While the ideal amount varies based on your child’s college goals and your financial situation, aiming to cover at least 50% of the projected costs of a four-year public in-state university is a solid starting point.

Q: What happens if I contribute too much to my 529 plan?

A: There are no strict annual contribution limits for 529 plans, but states do have lifetime maximums. If you exceed these limits, you may face penalties, but you can change the beneficiary to another family member or use the funds for qualified educational expenses.

Q: Can I use my 529 plan for expenses other than college tuition?

A: Yes, the SECURE Act 2.0 allows for broader usage of 529 funds, including K-12 tuition, apprenticeship programs, and student loan repayments.

Q: Should I consider opening a 529 plan for my teenager if they are already in college?

A: Yes, even if your child is already in college, a 529 plan can still be beneficial. The funds can be used for future educational expenses, such as graduate school or continuing education.

Conclusion

Determining how much to contribute to a 529 plan for your teenager requires careful consideration of your child’s college goals, your existing savings, and the latest changes to these tax-advantaged accounts. By understanding the factors at play and maximizing the available benefits, you can develop a comprehensive strategy to ensure your child has the resources they need to pursue their higher education aspirations.

Take the time to review your current 529 plan status, calculate your target savings, and set up automatic contributions to stay on track. With a little planning and the right approach, you can help your teenager afford their dream school and set them up for long-term financial success.

MORE FROM findbusiness.me