Strategies For High Earners And Achieving Financial Freedom: How To Make 500k A Year

Earning $500,000 a year might sound like a dream, but for many, it’s a reality that can come with its own set of financial challenges. This article examines the complexities of high income, including the impact of high taxes, lifestyle inflation, and societal pressures. It also provides practical strategies for achieving financial freedom, even when you’re making how to make 500k a year.

The High-Income Trap: Why $500,000 Might Not Be Enough

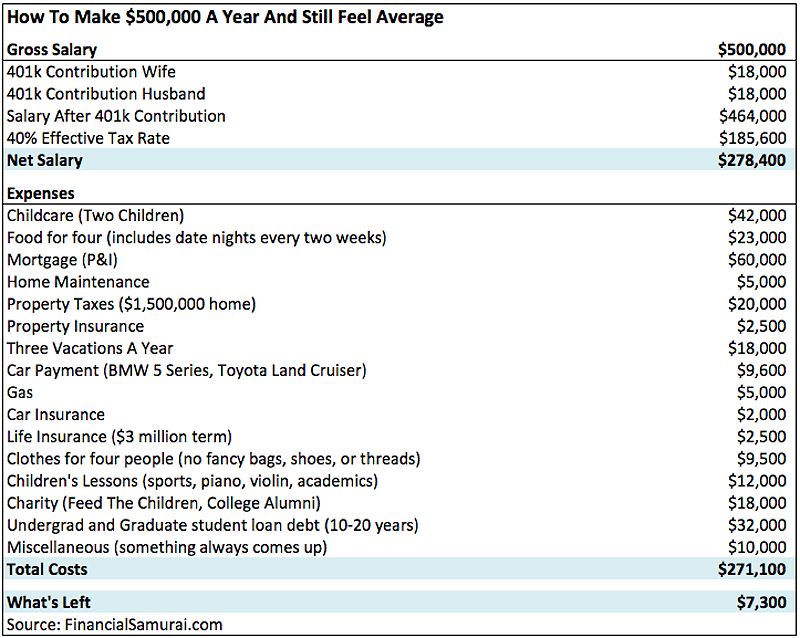

When you think about how to make 500k a year, it’s easy to assume that life will be a breeze. However, many high earners discover that their impressive salary can come with a hefty price tag. Let’s break down some common pitfalls that can make even a $500,000 income feel insufficient.

High Taxes

The Bite of High Tax Brackets

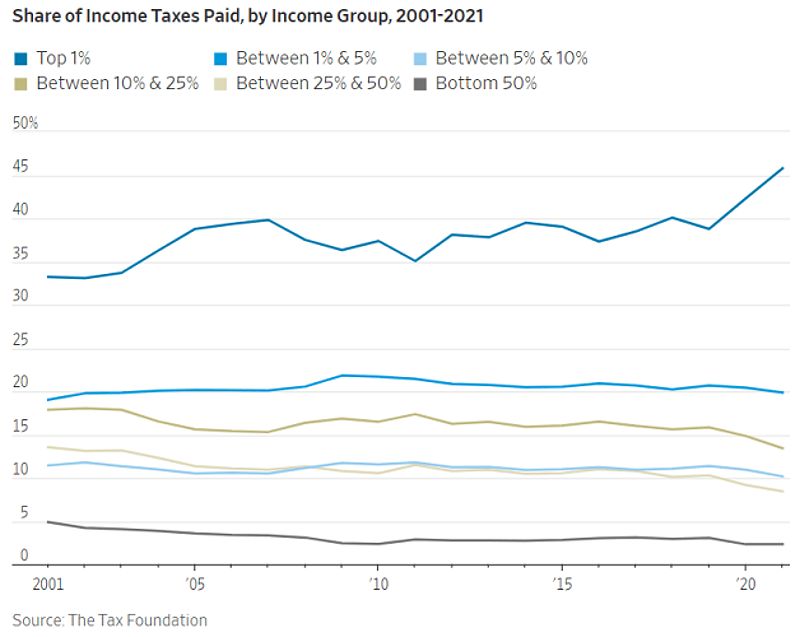

High-income earners are often shocked to learn just how much of their hard-earned money goes to taxes. With federal income tax rates reaching up to 37%, plus state and local taxes, your take-home pay can be significantly reduced. For many, the effective tax rate can soar above 40%, leaving you with a lot less to save or spend than you might expect.

Understanding Effective Tax Rates

Did you know that in certain states, high earners can face even steeper taxes? For instance, in California, the effective tax rate for those earning $500,000 can climb to around 50% when factoring in state taxes. Ouch! That’s a hefty slice of your income going straight to Uncle Sam and local governments.

Lifestyle Inflation

The Slippery Slope of Spending More

As your income rises, it’s all too easy to let your spending habits inflate along with it. This phenomenon, known as lifestyle inflation, can lead to a cycle of debt and financial instability. Many high-income earners end up spending more on luxuries, from expensive cars to lavish vacations, thinking they can afford it. Spoiler alert: they often can’t.

The Psychology of Spending

The desire for status can be a sneaky culprit behind lifestyle inflation. When you’re surrounded by friends or colleagues who also earn big bucks, the pressure to keep up can be overwhelming. Suddenly, a $100 dinner out doesn’t feel extravagant—it feels necessary to maintain your social standing. It’s a slippery slope, my friends.

Comparison and Keeping Up with the Joneses

The Social Pressure of Comparison

Ah, the age-old battle of keeping up with the Joneses. It’s a real issue for many high-income earners. The pressure to compare your lifestyle to others can lead to unnecessary spending and feelings of inadequacy. You might find yourself scrolling through social media, seeing your friends’ exotic vacations or luxury purchases, and thinking, “I need that too!” Before you know it, your bank account takes a hit.

The Illusion of Wealth

Thanks to social media, the perception of wealth can often be distorted. It’s easy to forget that what you see online is often just a highlight reel. People tend to showcase their best moments, which can create unrealistic expectations about what it means to be financially successful. Remember, not everything that glitters is gold.

Compelling Examples

Take, for instance, the story of Mike and Sarah, a couple earning $500,000 a year. They live in a gorgeous home, drive luxury cars, and take extravagant vacations. Yet, they struggle to save and often find themselves living paycheck to paycheck. By examining their spending habits and making some adjustments, they managed to break free from the high-income trap and start saving for their future. Their story serves as a reminder that it’s not just about how much you earn, but how you manage your money.

How to Make 500k a Year: Strategies for Maximizing Your Income

So, how do you escape the high-income trap? Here are some actionable strategies to help you optimize your finances and make the most of your $500,000 income.

Tax Optimization

Tax Planning Strategies

To minimize your tax burden, start by exploring tax deductions and credits that apply to your situation. For example, if you own a home, you can deduct mortgage interest, which can provide immediate relief. If you’re charitable, don’t forget to claim those donations!

Tax-Advantaged Investment Vehicles

Consider maximizing your contributions to tax-advantaged accounts like 401(k) plans, Roth IRAs, and health savings accounts (HSAs). These accounts not only help you save for retirement but also reduce your taxable income. By utilizing these vehicles, you can keep more of your hard-earned cash in your pocket.

Investment Income vs. W2 Income

Did you know that investment income can be taxed at a lower rate than your regular paycheck? By focusing on building a portfolio that generates passive income through investments, you can significantly reduce your overall tax liability. It’s a win-win!

Expense Management

Living Below Your Means

To build long-term wealth, it’s essential to prioritize your financial goals over short-term pleasures. Start by creating a detailed budget that tracks your spending in key areas like housing, transportation, and discretionary expenses. This way, you can identify areas where you can cut back.

Negotiating Costs

Don’t be afraid to negotiate for better deals on major expenses! Whether it’s your mortgage, childcare, or education costs, being proactive can save you thousands each year. Remember, you have the power to make your money work for you.

The Power of Small Changes

Small changes can lead to significant savings over time. For instance, consider dining out less frequently or opting for more affordable entertainment options. Each little adjustment can add up and help you redirect those savings toward building wealth.

Smart Investment Strategies

Diversification

With a $500,000 income, you have the opportunity to build a diversified investment portfolio. Start by allocating your income across various asset classes—think stocks, bonds, real estate, and alternative investments. Diversification helps mitigate risk and can lead to more stable returns.

Passive Income Generation

Consider investing in passive income-generating assets, such as rental properties or online businesses. These can provide a steady cash flow that supplements your employment income and helps you work toward financial independence.

Investment Vehicles for High-Income Earners

Explore investment options that are particularly suitable for high-income earners, such as private equity, venture capital, or angel investing. These opportunities can offer higher returns, albeit with increased risk. Always do your research and consider seeking professional advice.

Pros and Cons of Financial Strategies

Tax Optimization

- Pros: Lower tax liability, increased disposable income, greater financial flexibility.

- Cons: Requires knowledge and expertise, potential for complexity, potential for audit risk.

Expense Management

- Pros: Increased savings, reduced debt, greater financial security.

- Cons: Requires discipline and effort, may involve lifestyle changes, potential for feelings of deprivation.

Smart Investment Strategies

- Pros: Potential for long-term wealth growth, increased financial security, potential for passive income generation.

- Cons: Involves risk, requires knowledge and research, potential for market volatility.

Building a Financial Fortress for the Future

As a high-income earner, focusing on long-term wealth-building strategies is vital for ensuring your financial security and independence.

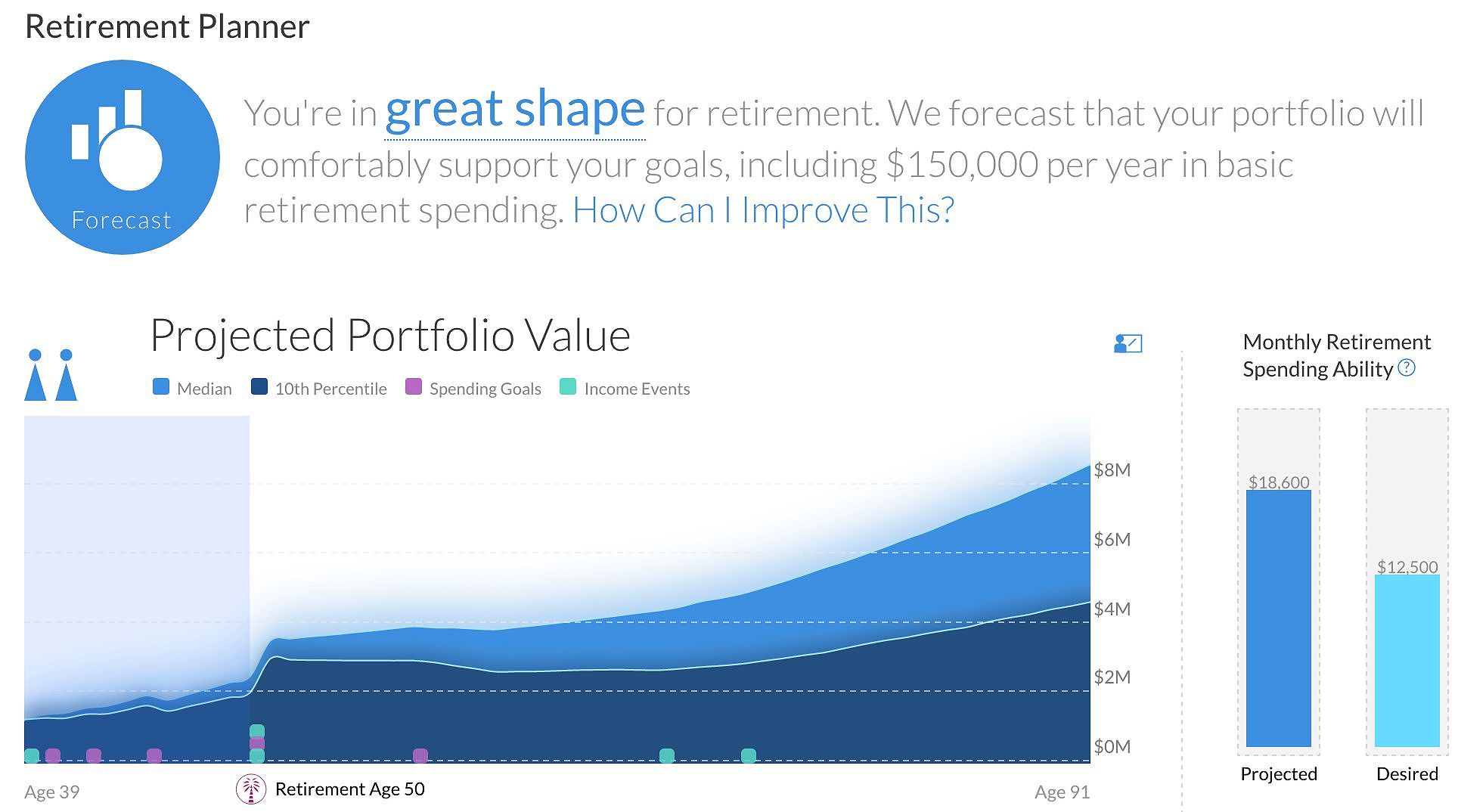

Retirement Planning

Maximizing Retirement Contributions

Don’t underestimate the importance of maximizing your contributions to employer-sponsored retirement plans like 401(k)s and 403(b)s. These accounts can help you build a substantial nest egg for the future.

Exploring Other Retirement Savings Options

Consider additional retirement savings options, such as Roth IRAs and traditional IRAs. Understanding the various retirement account options available can help you choose the best strategies for your financial goals.

Estate Planning

Protecting Your Assets

Implementing estate planning strategies, such as wills, trusts, and life insurance policies, can help you minimize the impact of taxes and legal fees on your estate. Protecting your assets ensures a smooth transition of wealth to your loved ones.

Minimizing Taxes and Legal Fees

A well-thought-out estate plan not only protects your assets but also helps minimize the tax burden on your estate. This can provide peace of mind knowing that your loved ones will be taken care of after you’re gone.

Financial Independence

Defining Financial Independence

Financial independence is the point at which your investment and passive income streams can sustain your desired lifestyle without relying on active employment. Achieving this can provide you with the freedom to pursue your passions and enjoy life on your terms.

Creating a Financial Independence Plan

To work towards financial independence, set specific financial goals, such as reaching a certain net worth or generating a specific amount of passive income. Break these goals into actionable steps to make steady progress toward your aspirations.

Statistics to Consider

- On average, high-income earners save only about 10% of their income for retirement, which is significantly lower than the recommended savings rate of 20-30%.

- A study found that nearly 60% of high-income earners do not have a comprehensive estate plan in place, leaving their assets vulnerable to taxes and legal fees.

Tips and Best Practices

- Create a retirement plan that includes maximizing contributions to tax-advantaged accounts.

- Develop an estate plan that protects your assets and minimizes taxes.

- Build a diversified investment portfolio that balances risk and potential returns.

FAQ

Q1: How much should I be saving each year with a $500,000 income?

A: Aim to save at least 20-30% of your gross income for long-term wealth building, including contributions to retirement accounts and investments.

Q2: What are the best investments for high-income earners?

A: Consider a diversified portfolio that includes stocks, bonds, real estate, and alternative investments. Seeking professional advice can help you determine the best strategies for your individual circumstances.

Q3: How can I escape the “high-income trap” and achieve financial freedom?

A: Focus on tax optimization, expense management, and smart investing. By implementing these strategies, you can minimize your tax burden, reduce your cost of living, and build a diversified investment portfolio that generates sustainable wealth.

Conclusion

Making $500,000 a year is an impressive achievement, but it doesn’t automatically guarantee financial security. By understanding the unique challenges high-income earners face and implementing a comprehensive financial strategy, you can break free from the “high-income trap” and build a secure financial future.

The journey to financial freedom is a marathon, not a sprint. Start by taking control of your finances, optimizing your tax situation, and investing in a diversified portfolio of assets. With discipline, patience, and a commitment to your long-term goals, you can turn your $500,000 income into a source of lasting wealth and freedom.

Ultimately, achieving financial security requires a proactive approach. Whether it’s through smart budgeting, strategic investments, or careful tax planning, each step you take can lead you closer to financial independence. Embrace the journey, and remember that every small decision contributes to your larger financial picture.

MORE FROM findbusiness.me